Posted 8/2/2022 Clorox Odyssey Earnings

Preview: $CLX FQ4 Estimates - Sharp Organic Sales Growth (H&W Segment)

Using our updated Odyssey2 panel, our data science team has analyzed 2022 FQ4 sales of $CLX brands to arrive at a preview of Clorox's upcoming earnings call.

Commentary

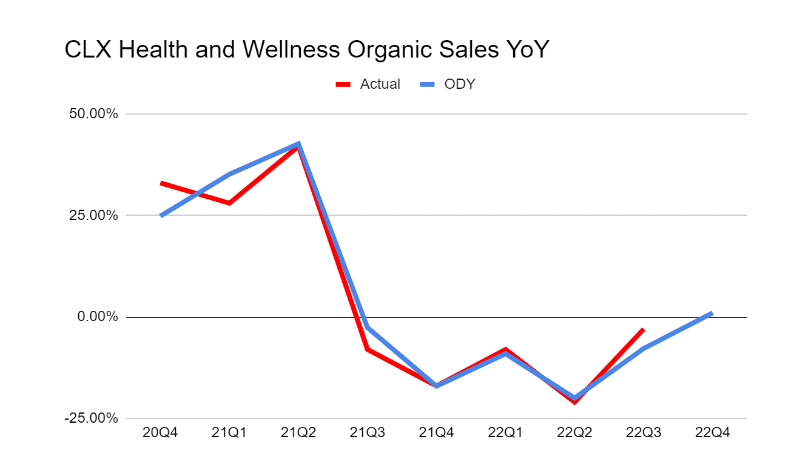

DecaData’s data panel shows sharp acceleration in Organic Sales Growth for CLX Health & Wellness segment, for 2022 FQ4 as compared to FQ3. This was driven by a strong acceleration (~300bps) in the pace of Pricing YoY, as well as a continuing recovery (~100bps) in the pace of Volume YoY for this segment, compared to FQ3.

We also observe relatively flat / slightly accelerating Organic Sales Growth for the Household segment, which was partially offset by deceleration in Organic Sales Growth for the Lifestyle segment. This combined with the strong acceleration in Health & Wellness to suggest that CLX’s overall Organic Sales Growth might surprise to the upside.

Forecast Data

Odyssey 2 data best lends itself to measuring and modeling CLX’s Health and Wellness segment. We are forecasting slight accel in organic sales year-on-year, driven strong accel of Pricing YoY and moderate volume growth YoY.

Ticker CLX

| Segment | Metric | Actual 2022 FQ3 | ODY Estimates 2022 FQ4 | Lower | Midpoint | Upper | Direction |

|---|---|---|---|---|---|---|---|

| CLX Health & Wellness | Organic sales YoY | (3.0%) | 0.2% | 1.0% | 1.5% | Accel | |

| CLX Health & Wellness | Pricing YoY | (3.0%) | (0.5%) | 0.0% | 0.5% | Accel | |

| CLX Health & Wellness | Volume YoY | 0.0% | 0.2% | 0.7% | 1.2% | Accel |

Health and Wellness Segment Organic Sales Chart

© 2023 DecaData • • Privacy opt-out