Posted 7/28/2022 CHD Odyssey Earnings

Preview: $CHD Q2 Earnings - Organic Sales Decelerate

Using our updated Odyssey2 panel, our data science team has analyzed 2022 FQ22 sales of $CHD brands to arrive at a preview of Church & Dwight's upcoming earnings call.

Commentary

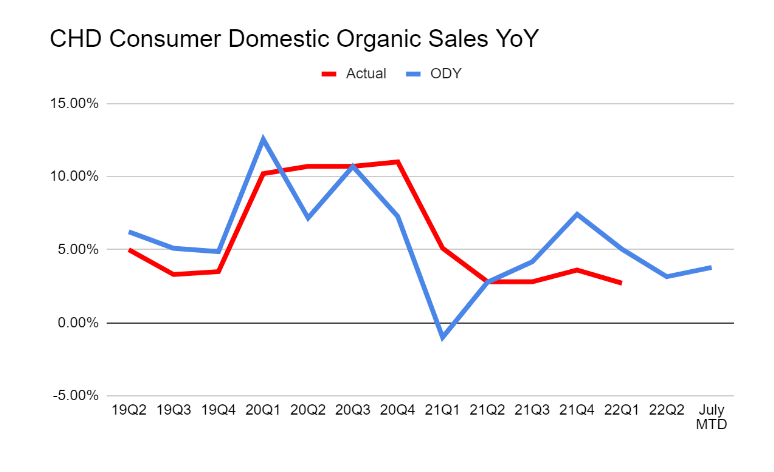

DecaData’s data panel shows deceleration in the pace of Volume YoY for CHD Consumer Domestic segment, for 2022 FQ2 as compared to FQ1. During FQ2, the pace of Pricing YoY remained relatively flat / slightly decelerating compared to FQ1. Altogether, these resulted in deceleration in Organic Sales growth for this segment compared to 2022 FQ1.

We observe from our POS data that the headwinds in volume appeared to show little signs of improvement during FQ2 as well as July month-to-date. This posed challenges for the segment’s overall organic growth and might steer its result towards the lower end of management’s guidance.

Forecast Data

Odyssey 2 data best lends itself to measuring and modeling CHD’s consumer domestic segment. We are forecasting strong pricing growth to offset decline in volume that nets out at +2.35% organic sales growth on Q2 21.

Ticker CHD

| Segment | Metric | Actual 2022 FQ1 | ODY Estimates 2022 FQ2 | Lower | Midpoint | Upper | Direction |

|---|---|---|---|---|---|---|---|

| CHD Consumer Domestic | Organic sales YoY | 2.70% | 2.10% | 2.35% | 2.60% | Decel | |

| CHD Consumer Domestic | Pricing YoY | 8.70% | 8.30% | 8.50% | 8.70% | Flat/Decel | |

| CHD Consumer Domestic | Volume YoY | (6.00%) | (6.50%) | (6.20%) | (6.00%) | Decel |

Consumer Domestic Organic Sales Chart

© 2023 DecaData • • Privacy opt-out